Scaling Smart: Why Many Companies Choose a Fractional CFO

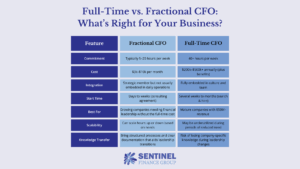

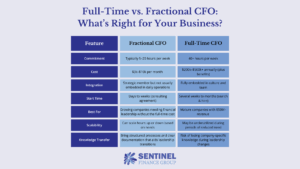

Many growing companies turn to fractional CFOs for cost-effective financial strategy, expert insight, and flexible leadership during key growth stages.

From the CEO

Many growing companies turn to fractional CFOs for cost-effective financial strategy, expert insight, and flexible leadership during key growth stages.

High-performing companies pair budgeting with forecasting to stay agile and informed. Learn how forecasting drives smarter, data-backed financial decisions.

Every business should aim for a 10–15% profit margin. This often surprises business owners, but profit is what sustains, grows, and adds value to a business.

A CFO brings strategic financial leadership, drives growth, and makes confident, informed decisions—crucial for scaling businesses facing increasing complexity.

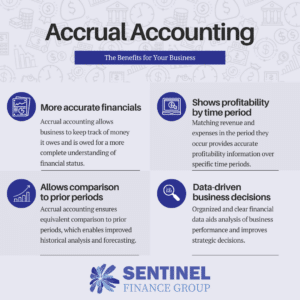

Businesses can either use the cash or accrual method of accounting. Most companies–especially companies that are trying to grow–should use accrual accounting.

Cash flow forecasts help businesses strategically plan the amount of cash they have in their bank accounts available for future operations and expenditures.

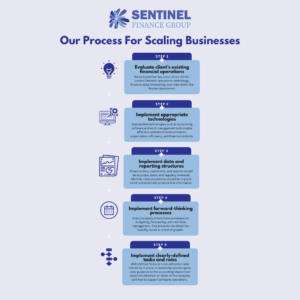

Sentinel Finance Group’s process results in a highly effective financial department that produces accurate information which is used to grow the business.

Fractional CFO services can help IT consulting companies manage profitability and cash flow challenges to effectively scale and grow their operations.

Despite numerous fractional CFO firms to choose from, many businesses choose to work with Sentinel Finance Group for a few specific reasons.