How Cash Determines a Business’s Long Term Success

Cash is the lifeblood of a business, and keeps it afloat. Good decisions about spending and earning revenue in the short term lead to success in the long term.

From the CEO

Cash is the lifeblood of a business, and keeps it afloat. Good decisions about spending and earning revenue in the short term lead to success in the long term.

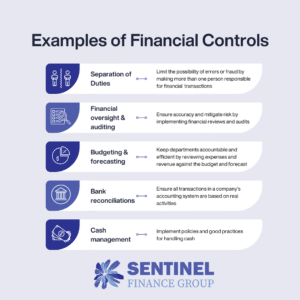

Financial controls are systems a company sets up to ensure the accuracy of its finances. Financial controls prevent financial errors, fraud, and inefficiencies.

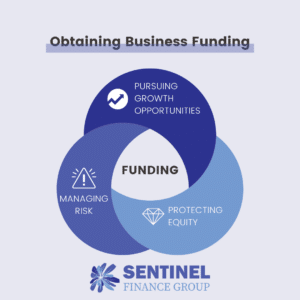

Some business funding sources require equity in return for capital. It’s important to consider the balance between growth opportunities & protecting your equity.

The four main funding sources for businesses are bank loans, venture capitalists, angel investors, and self-funding. Each comes with pros and cons to consider.

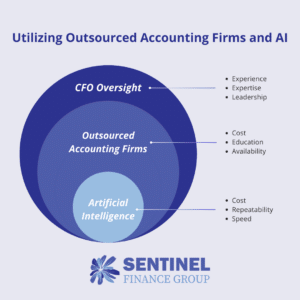

Outsourcing and AI can be good tools to utilize in your business. However, it’s still important to have highly skilled financial oversight for a few reasons.

The profit & loss statement (P&L) is one of the three main financial statements a business needs. The P&L measures a company’s financial performance and profit.

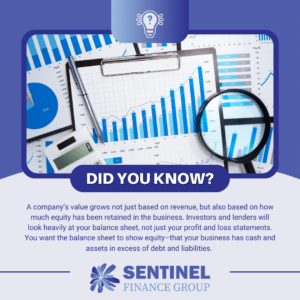

Many business owners want to know how much their business is worth. Many think business value is based solely on revenue, but there’s more that goes into it.

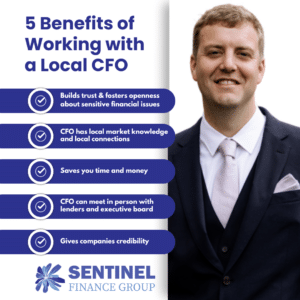

While it’s true that most finance work can be done remotely, working with a local fractional CFO can build trust and foster openness about sensitive issues.

It’s vital for companies to have regular financial meetings with a CFO so important trends in the financial performance can be highlighted and discussed.

info@sentinelfinancegroup.com

+1 (913) 730-0468