Many small business owners hire a bookkeeper and assume they’ve checked the “finance” box. After all, it works—for a while.

But here’s the truth: if a bookkeeper is your only financial hire, your business might be surviving… but it’s not set up to truly grow.

A bookkeeper is an important part of your financial team—but they are not your entire financial department. If you want to scale your business, make smarter decisions, or prepare for what’s next, you need more than clean books. You need financial leadership. You need a CFO.

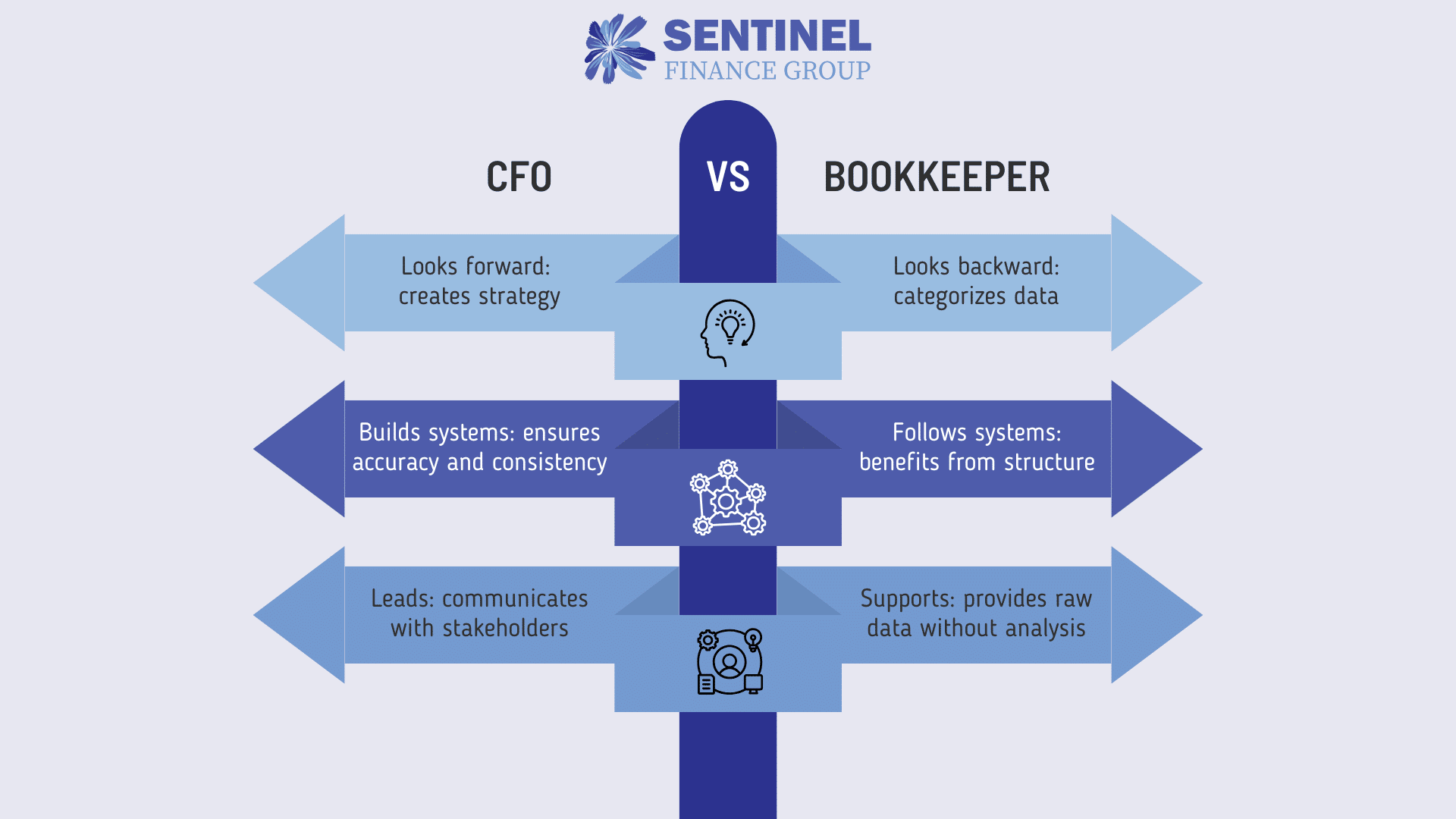

Bookkeepers Record the Past. CFOs Shape the Future.

Let’s start with what a bookkeeper does: they enter and categorize your financial transactions, reconcile accounts, and help make sure you’re ready for tax time. Their role is essential, but it’s focused on looking backward—recording what already happened.

A CFO, on the other hand, uses that data to look forward. They analyze your numbers to tell the story behind them and help you make strategic, informed decisions. This includes:

- Identifying which revenue streams are most profitable

- Pinpointing inefficiencies in your COGS or inventory

- Evaluating how your business stacks up against industry benchmarks

- Advising on margins, cash flow, hiring, pricing, and expansion

- Assessing whether your team is operating effectively

Most bookkeepers aren’t trained in these areas—and they aren’t expected to be. That’s not their job. But it is the job of a CFO.

Without Oversight, Bookkeeping Can Go Off Track

Another critical issue? Bookkeeping without expert oversight can lead to costly errors—errors that often go unnoticed until it’s too late.

Here’s a common scenario: each bookkeeper you hire uses a slightly different method for categorizing financial data. Without clear systems and leadership in place, your books become increasingly messy and inconsistent over time. Eventually, your financials are so complex and unclear that preparing accurate statements—or presenting data to investors or banks—is an expensive, time-consuming nightmare.

A CFO solves this. They provide guidance and structure, ensuring your financial systems are not only accurate but scalable. They work with your bookkeeper to create a process that aligns with your goals and sets your business up for long-term success.

CFOs Add Strategic, Professional Financial Leadership

A bookkeeper keeps the books. A CFO translates them into insight.

One of the most overlooked aspects of financial leadership is communication. As your business grows, you’ll likely need to present your financials to investors, lenders, or a board. This isn’t just about the numbers themselves—it’s about how the story of those numbers is told.

A CFO knows how to interpret your data and communicate it in a way that inspires confidence. They have the training and expertise to provide clear, actionable recommendations and represent your company in high-stakes financial conversations. This is where real growth—and real risk mitigation—happens.

Yes, CFO Services Cost Money—But So Does Growth Without a Plan

It’s common for business owners to hesitate when it comes to investing in CFO services. But the reality is this: it’s far more costly in the long run to fly blind.

Relying on your gut, or on incomplete financial information, can lead to missed opportunities, overhiring, underpricing, poor cash management, and more.

At Sentinel Finance Group, we offer fractional CFO services designed specifically for growing businesses that need strategic financial leadership—without the full-time salary of a traditional CFO. We tailor our approach to our clients’ unique goals, challenges, and stage of growth.

Don’t Let “Good Enough” Hold You Back

Your bookkeeper helps keep your business compliant. A CFO helps you grow it.

If you’re not sure whether your business needs more strategic financial support—or you just want a clearer picture of your financial health—start with our Financial Health Assessment.

We’ll take a close look at your financial systems, reporting, and performance to uncover risks, spot missed opportunities, and help you understand what’s working (and what’s not). Whether or not you’re ready for CFO services, you’ll walk away with practical, actionable insights tailored to your business.

Click here to learn more about the Financial Health Assessment.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides CFO services and controller services to local businesses.