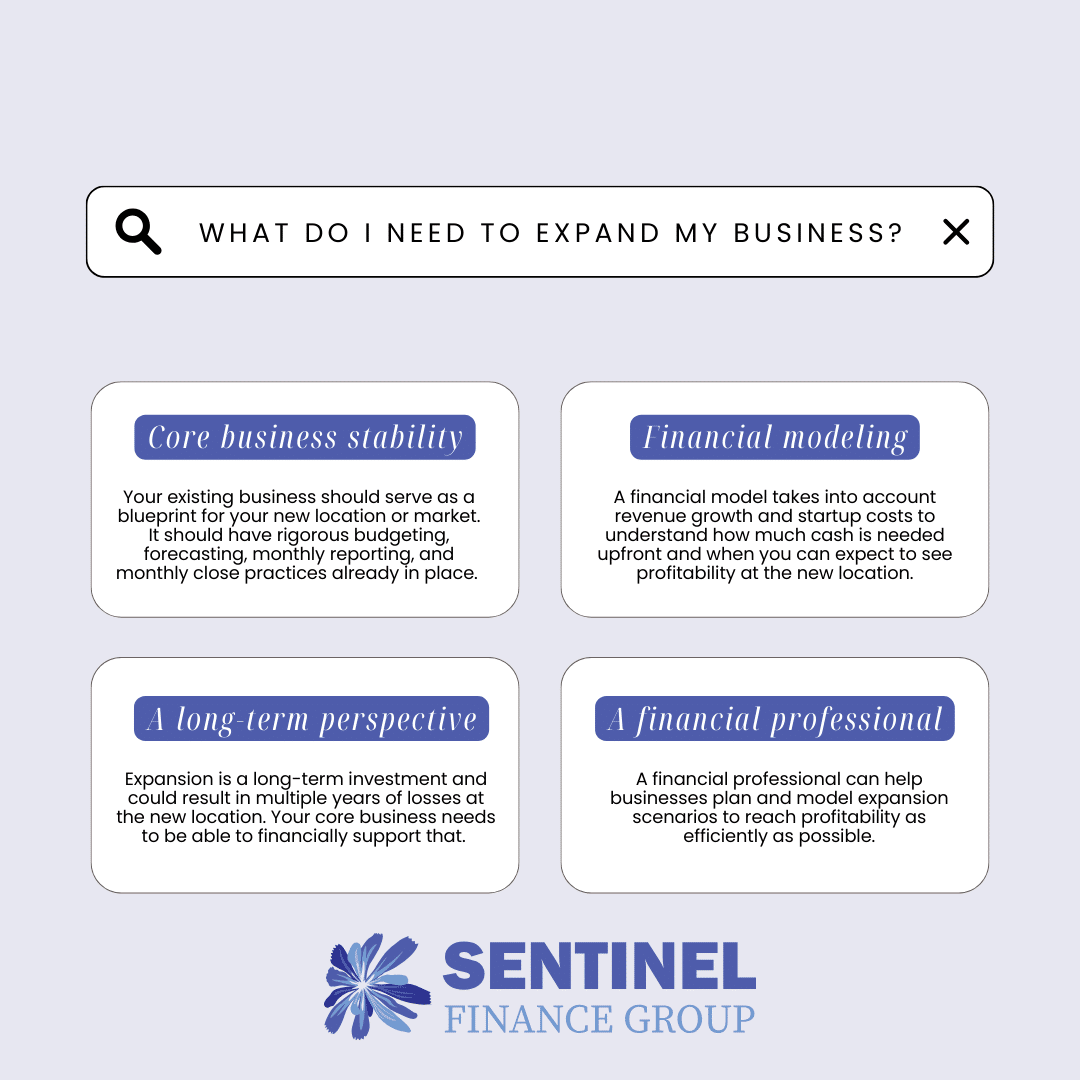

I’m approached by many business owners who are interested in expanding their business to a new location or market. In order to expand your business successfully, it’s important to have a few financial pieces in place.

Ultimately, you want your current business to serve as a blueprint for your new location or market. It’s vital to have existing weekly, monthly, and annual financial systems in place that are easy to manage and repeatable. Your core business should have rigorous budgeting, forecasting, monthly reporting, and monthly close practices already in place.

Your existing business forecast and budget can be used to understand the potential revenue and costs of expanding. It’s also important to take into account additional startup costs, which may include obtaining a new building, hiring new staff, or capital expenditures such as machinery or vehicles. This can all be built into a model to understand how much cash is needed upfront, how much will be needed to fund the shortfall on a monthly basis, and when you can expect to see profitability at the new location.

Many business owners aren’t happy with the profit levels of their existing core business, so they think the answer is expanding to increase revenue and tap into economies of scale. However, it’s important to recognize that the inefficiencies, effort, and upfront costs of expansion far exceed any of those economies of scale in the short term. Expansion could result in multiple years of losses at the new location, and your core business needs to be able to financially support that. Expansion is a long-term investment that will pay off after many years.

On the other hand, a good reason to consider expansion is when your core business is already running efficiently and is profitable, but revenue is capped by how many customers are in your market.

Sentinel Finance Group helps businesses build an effective financial structure to use as a blueprint for expansion, and we provide professional reporting to help businesses obtain financing from lenders and investors. We help our clients plan and model expansion scenarios, and incorporate reporting for the new location into their existing reporting structure to reach profitability as efficiently as possible.

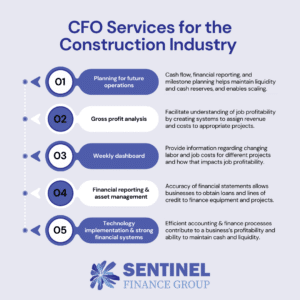

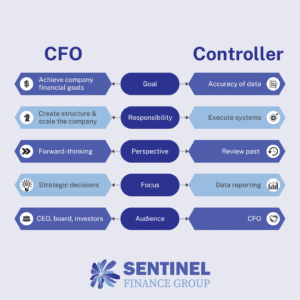

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.