A CFO’s Guide to Expanding Your Business the Right Way

Learn the key signs your business is ready to grow and how to plan expansion without risking profits or cash flow.

From the CEO

Learn the key signs your business is ready to grow and how to plan expansion without risking profits or cash flow.

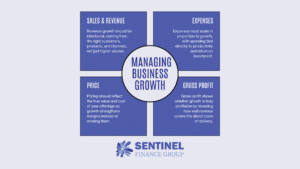

Growing fast but profits aren’t keeping up? Learn how to manage business growth intentionally through sales, expenses, pricing, and gross profit.

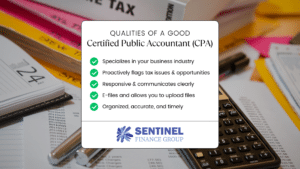

Not sure if your CPA is helping or hurting your business? Discover the key signs of a good CPA, common warning signs, and what to expect.

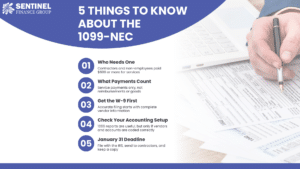

Learn what businesses need to know about filing the 1099-NEC, including who qualifies, deadlines, common mistakes, and how to stay compliant.

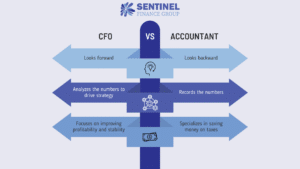

Business Owners: think an accountant is enough? Discover how a fractional CFO helps businesses plan growth, improve cash flow, and boost profits.

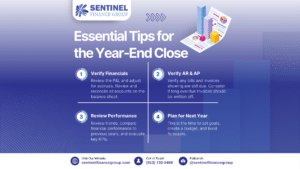

Get a complete year-end close checklist for small businesses. Learn the essential steps to reconcile accounts, clean up financials, and prepare for 2026.

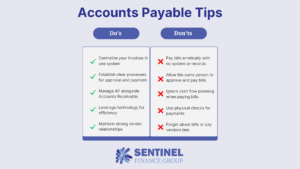

Proper accounts payable management protects cash flow, reduces errors, and strengthens vendor relationships. Optimize your AP process with these best practices.

A company can be profitable yet still face cash flow issues without strong accounts receivable management. Improve cash flow with these AR management strategies.

Choosing the right accounting software is one of the most important financial decisions a business can make. Is your accounting software holding you back?