As companies grow, financial complexity increases. Basic finance and accounting functions — such as bookkeeping and tax preparation — eventually become insufficient. At that point, leadership requires more than number tracking. It requires a financial expert who can align operations and financial systems with long-term goals and evolving challenges.

This is where a Chief Financial Officer (CFO) comes in.

A CFO does more than manage books. They build and optimize financial processes that reflect where the company is today and where it’s headed tomorrow.

What Does a CFO Actually Do?

At the highest level, a CFO sets the financial tone and strategy for the company. They lead the finance and accounting teams and oversee the financial operations of the company. They are the bridge between the CEO’s vision and the financial structure needed to achieve it.

A CFO’s work typically begins by understanding the owner’s strategic goals. From there, they dive into financial data, analyze trends, identify opportunities and risks, and develop a roadmap with actionable strategies to support growth. Their influence spans board meetings, executive discussions, and ongoing reporting.

Forecasting and financial modeling are core responsibilities. A CFO projects financials into the future — one year, five years, or longer — to ensure the company meets growth targets without compromising cash flow. They set strategic objectives, such as a target profit margin, and determine what must happen across revenue, cost of goods sold, gross profit, and operating expenses to reach those targets.

Scenario modeling is another key function. A CFO evaluates potential outcomes for questions like:

-

- What are the financial implications of opening a new location?

-

- How would expanding the sales team affect profitability?

-

- What are the returns on investing in new equipment or technology?

Each scenario carries financial consequences. The CFO identifies the costs, risks, and rewards so leadership can make confident, well-informed decisions.

Signs It’s Time to Hire a CFO

Here are common indicators that a company may be ready for CFO-level support:

1. Increasing financial complexity.

In early stages, owners often manage financial decisions. As the company grows — across locations, revenue streams, or investor relations — the stakes and complexity rise. At this point, strategic financial leadership becomes essential.

2. Limitations of accounting support.

Accountants and CPAs are vital for historical reporting, compliance, and tax preparation. However, they typically do not provide forward-looking strategy. A CFO brings a proactive approach — using data to guide decisions, not just report on them.

3. Need for a strategic financial partner.

Key decisions involving hiring, expansion, capital investment, or financing require both speed and expertise. A CFO provides decision-making leadership when it matters most.

4. External communication and credibility.

Whether dealing with banks, bonding companies, private equity, or investors, a CFO presents the company’s financial narrative with clarity, professionalism, and strategic vision.

What a CFO Brings to the Table

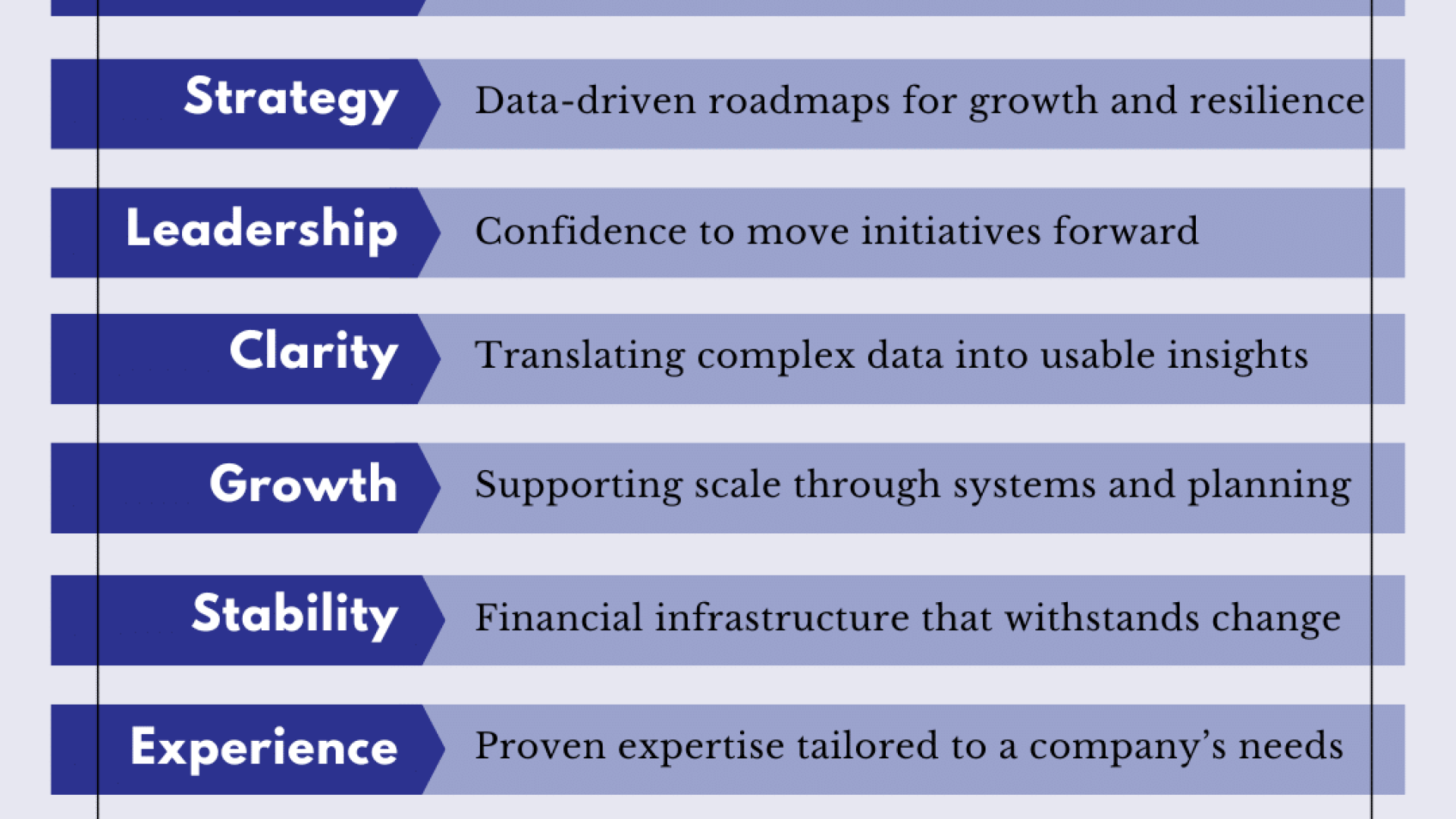

Bringing on a CFO adds more than financial oversight — it strengthens the executive team with leadership and vision. A CFO provides:

-

- Vision: Financial foresight with a multi-year outlook

-

- Strategy: Data-driven roadmaps for growth and resilience

-

- Leadership: Confidence to move initiatives forward

-

- Clarity: Translating complex data into clear, usable insights

-

- Growth: Supporting scale through systems and planning

-

- Stability: Building financial infrastructure that withstands change

-

- Experience: Proven expertise tailored to the company’s unique needs

-

- Assurance: A trusted partner for high-stakes financial decisions

A CFO isn’t just a number-cruncher — they are a strategist and decision-maker. Rather than simply reviewing historical spreadsheets, they operate in dynamic environments, adjusting course as conditions evolve.

Think of the CFO as the captain of a financial ship or the conductor of an operational orchestra — someone who sees the moving parts, understands how they interconnect, and leads the organization through both smooth and turbulent conditions.

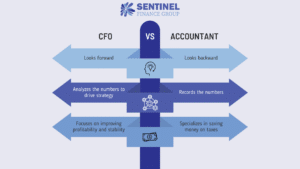

CPA vs. CFO: Understanding the Difference

Both CPAs and CFOs are financial professionals, but their focus is very different. A CPA specializes in tax compliance, reporting, and audits — looking backward to assess and document what has happened. They help develop strategies to minimize tax liabilities and ensure regulatory compliance.

A CFO, in contrast, is future-focused. They guide day-to-day financial decision-making, plan proactively, identify risks and opportunities, and make real-time executive decisions that directly impact business growth.

Hiring a CPA when a CFO is needed is like asking a medical specialist to act as a personal trainer. Both are experts — but in different disciplines.

Put simply: a CPA looks at the past. A CFO shapes the future.

Final Thoughts: When Is It Time to Hire a CFO?

The right time is when high-level financial decisions are too complex, frequent, or critical to manage without expert guidance. When the CEO no longer has the capacity — or desire — to wear every executive hat, a CFO becomes a key hire.

Trying to lead every function solo eventually creates bottlenecks. Scaling a business sustainably requires specialized leadership in every core area: operations, sales, HR, and finance.

A CFO is the expert for financial strategy, growth, and stability. They don’t just look at your numbers — they help you build your future.

How Sentinel Finance Group Can Help

Sentinel Finance Group is a fractional CFO firm that provides the high-level financial leadership growing companies need—without the overhead of a full-time executive. By stepping in as a strategic partner, we bring clarity to complex financial decisions, support scalable operations, and align financial systems with long-term objectives. Whether the goal is to improve profitability, prepare for expansion, or strengthen financial infrastructure, our team provides the structure, insight, and foresight required to move the business forward with confidence.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.