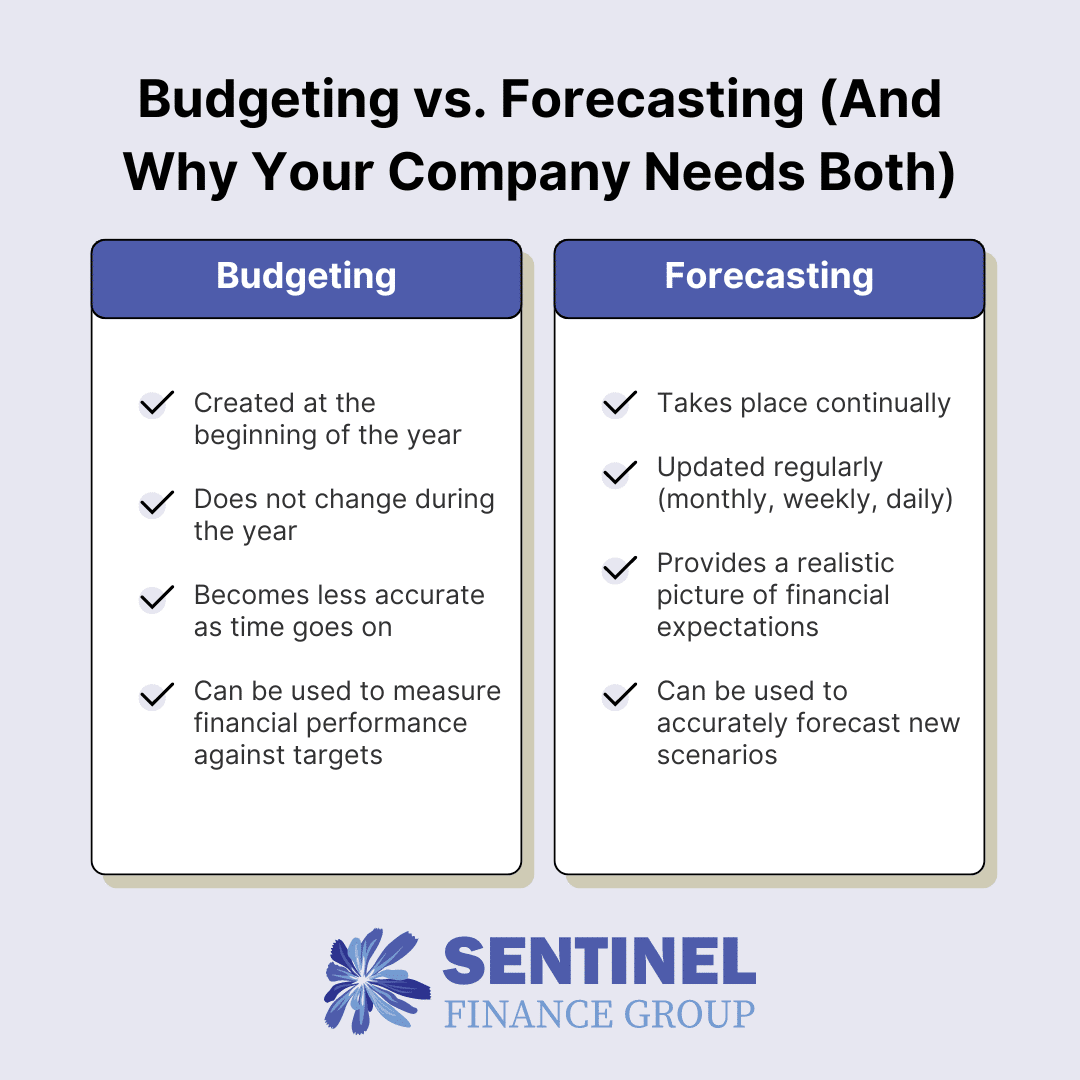

All companies should be budgeting and forecasting. Most companies are already familiar with budgeting. A budget is an annual plan for a company’s operations, and it is typically created either before the year starts or at the beginning of the year. Budgeting consists of planning revenue and constraining spending in order to be profitable (or in the case of high growth companies, to ensure there’s enough cash to sustain operations).

Forecasting is similar to budgeting because both practices review revenue and expenses. The difference is that forecasting takes place continually during the year and should be constantly updated based on reality. Forecasts can be updated on a monthly, weekly, or even a daily basis. A budget doesn’t change, and a company should measure its financial performance against it.

All departments should be involved in the forecasting process. This ensures the numbers are as accurate as possible, and it holds each department accountable to executing those numbers. The sales department should be informing the revenue forecast based on what is actually in the revenue pipeline.

Many companies don’t realize they need to be forecasting in addition to budgeting, but it’s important because budgets become less reliable as changes inevitably happen during the year. Forecasting provides a much more realistic picture that can inform strategic business decisions. Companies can also forecast specific scenarios such as adding positions, adding new types of revenue, or cutting a project.

Sentinel Finance Group helps with budget creation and planning, forecasting, and using this information for strategic planning. We also help businesses compare forecasts to budgets, understand why there are variances, and recommend if any actions are needed to correct issues.

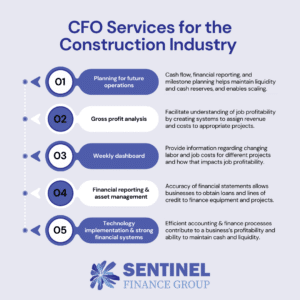

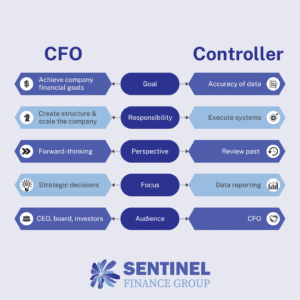

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.