Why Businesses Choose Sentinel Finance Group

Despite numerous fractional CFO firms to choose from, many businesses choose to work with Sentinel Finance Group for a few specific reasons.

From the CEO

Despite numerous fractional CFO firms to choose from, many businesses choose to work with Sentinel Finance Group for a few specific reasons.

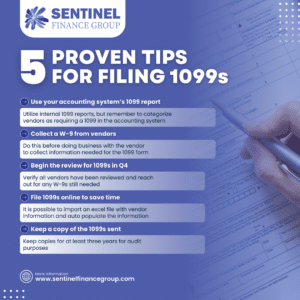

Form 1099-NEC is a tax form that businesses must file by the end of January. It reports payments from a business to non-employee contractors and vendors.

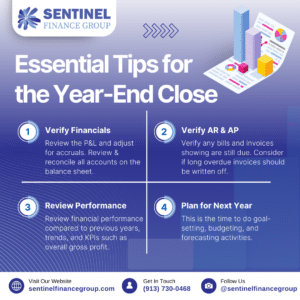

The year-end close is the process in which a company closes its books, making any adjustments to ensure the financials are accurate and ready for tax filing.

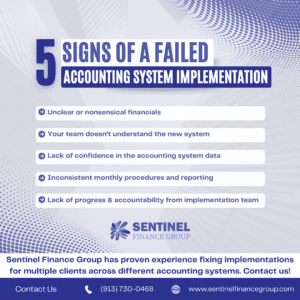

Companies often struggle during the implementation of a new accounting system, and their financial systems are left in a mess. Sentinel Finance Group can help.

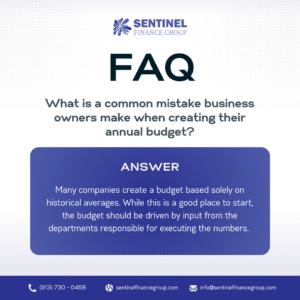

Every company should have an annual budgeting process. A budget sets financial goals for the next year, and it should be used to measure financial performance.

While every business will have unique KPIs based on its industry and goals, these 5 KPIs are important for every company to include in their monthly reporting.

CFO services can help commercial real estate companies manage profitability, cash reserves, and risk to effectively scale their operations.

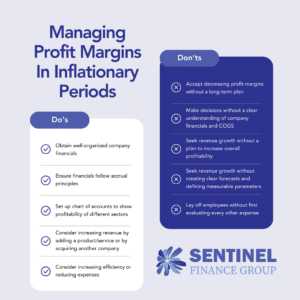

Many companies are experiencing decreasing profit margins as a result of higher expenses and higher labor costs, which will eventually lead to losses.

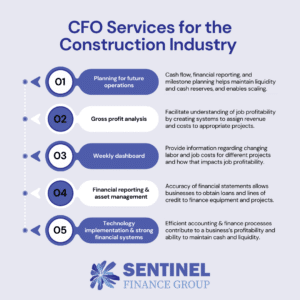

CFO services can help construction businesses proactively manage industry pain points to maintain a strong financial position and foster stability and growth.