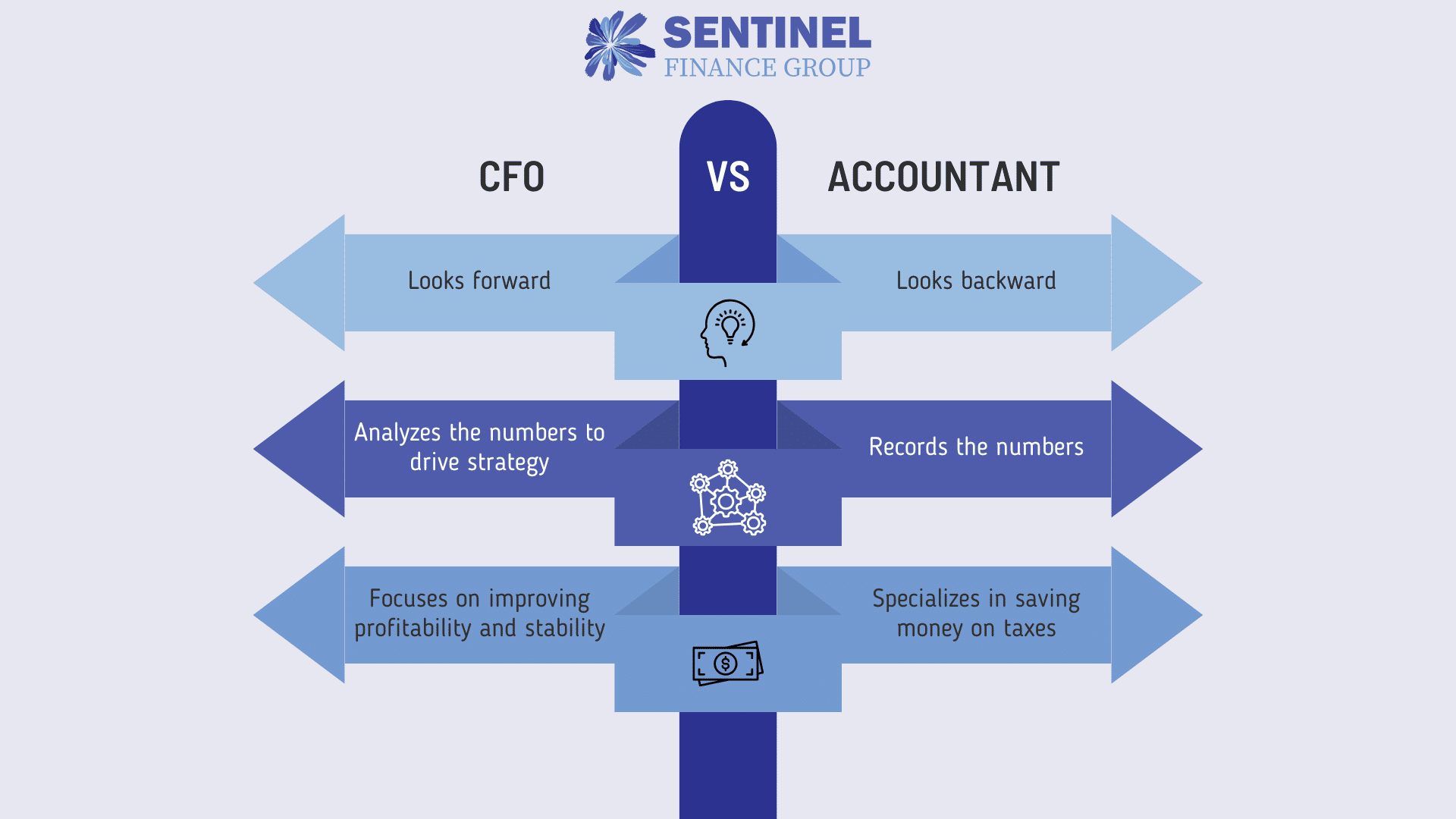

Many business owners assume that having an accountant is enough to keep their finances on track. Accountants handle taxes, keep the books in order, and make sure compliance boxes are checked. But there’s a big difference between managing the numbers and using them to drive strategy.

An accountant looks backward. A CFO looks forward.

Your accountant records what’s already happened. A CFO helps you shape what happens next.

The Difference Between Accounting and CFO Services

An accountant’s role is essential—they ensure accurate records, reconcile accounts, and keep you compliant. But once the books are closed, their job is largely done.

A CFO uses those same financials to build the future. That means developing forecasts and budgets that guide decisions, modeling different growth scenarios, and aligning spending with business goals. A CFO looks at the story behind the numbers, identifying inefficiencies, spotting opportunities, and putting structure around profitability.

Turning Financial Data into Strategy

At Sentinel Finance Group, we help clients increase profits to 10–15%. For a company doing $5 million in annual revenue, that can mean moving from $0–250,000 in profit to $500,000–$750,000—a significant difference that directly impacts growth, stability, and owner compensation. The increase in profit alone easily pays for the cost of a fractional CFO multiple times over.

We do this not by cutting costs blindly, but by planning smarter and helping owners make better financial decisions.

For example, we use scenario modeling to plan where the next dollar should go to generate the highest return, whether that’s investing in new hires, marketing, or technology. We evaluate where expenses can be reduced by increasing efficiency, and perform gross profit analysis to understand which revenue streams and pricing strategies are driving the most value.

We also provide cash flow planning to support a healthy, predictable operating environment. By mapping out cash inflows and outflows (such as client payments, payroll, rent, vendor costs) we help owners anticipate tight spots, maintain adequate reserves, and protect liquidity so the business can grow without strain.

These insights turn financial data into a clear plan for sustainable growth and stronger profitability.

Why a Fractional CFO Makes Sense

For many small and midsize businesses, hiring a full-time CFO isn’t realistic. That’s where a fractional CFO makes sense. You get senior-level financial leadership without the full-time cost.

We work alongside your accountant or bookkeeper to turn financial data into actionable plans that improve profit, strengthen cash flow, and support long-term stability.

If you’re ready to go beyond bookkeeping and start building a more profitable, predictable business, it may be time to bring on a fractional CFO.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides CFO services and controller services to local businesses.