For many business owners, managing accounts payable (AP) can feel like a juggling act. You are balancing vendor relationships, cash flow, and timely payments while trying to focus on running and growing the business. When AP is managed well, it becomes more than an administrative task. It becomes a strategic tool that strengthens financial health and supports long term stability.

What Is Accounts Payable?

A company’s accounts payable (AP) balance consists of the bills you owe your vendors. It is money that is due from your company but has not yet been paid. AP appears on your balance sheet as a current liability and represents the short term obligations your business needs to manage carefully.

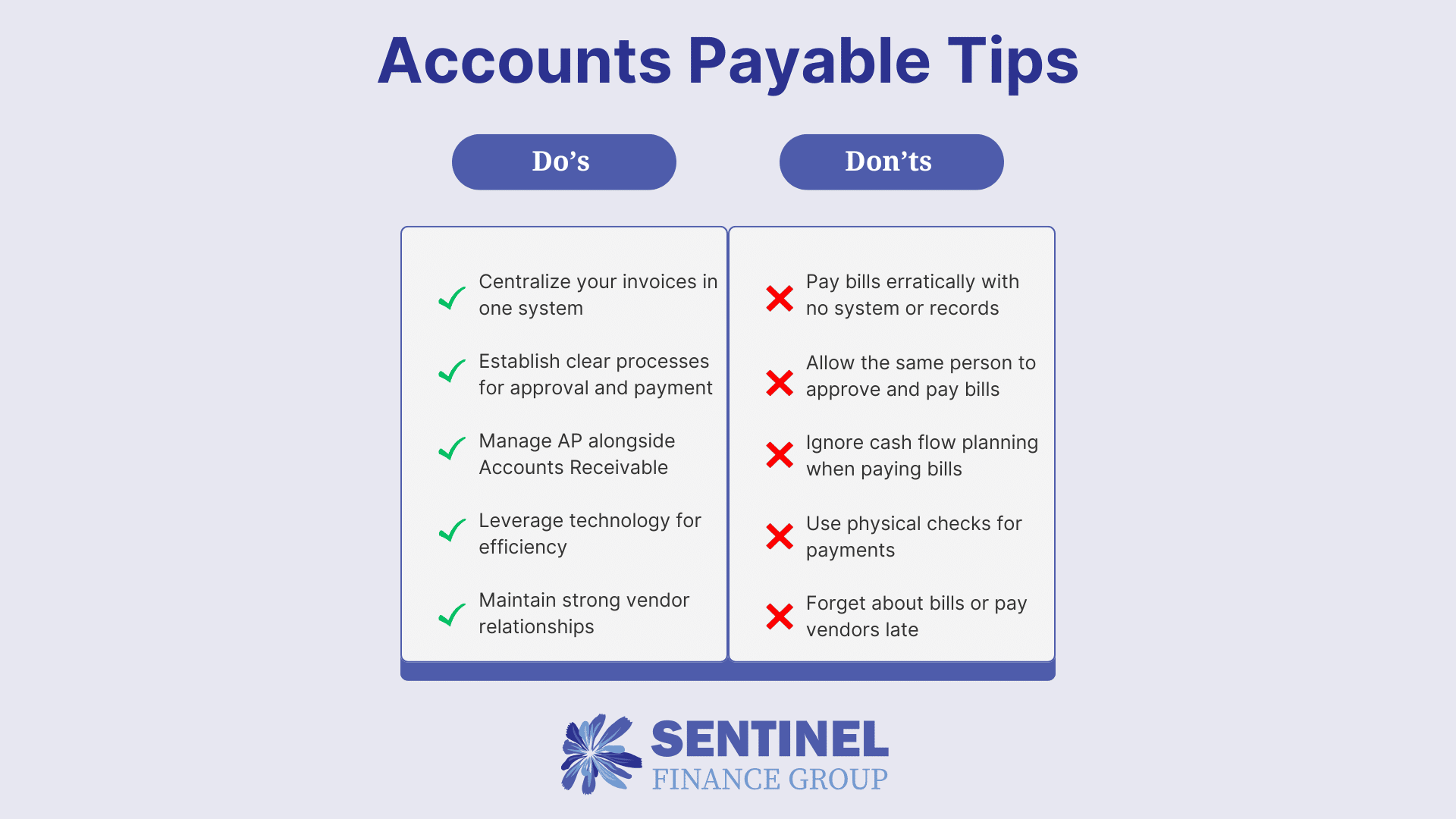

Here is how business owners should approach accounts payable management:

1. Centralize and Organize Your Payables

Start by keeping all invoices, due dates, and payment obligations in one system. Whether you use QuickBooks, NetSuite, Sage, or a dedicated AP platform, centralizing information helps prevent missed payments, improves accuracy, and keeps reporting clean and reliable.

2. Establish Clear Processes

Create clear procedures for receiving, approving, and paying invoices. This includes assigning responsibility for invoice reviews, setting timelines for approvals, and documenting any exceptions or disputes. A consistent workflow helps prevent errors, protects against duplicate payments, and creates accountability within your team.

3. Prioritize Cash Flow Management

AP should always be managed alongside accounts receivable (AR), which is the money owed to you. One important metric to monitor is “days in accounts payable,” which measures how long a bill stays in your system before it is paid.

While businesses want to collect incoming payments as quickly as possible, the opposite is true for outgoing payments. You should pay vendors on time and maintain good relationships, but you should avoid paying so quickly that it creates unnecessary pressure on cash flow. In most cases it is ideal for “days in AP” to be higher than “days in AR,” meaning your business brings in cash faster than it pays it out.

A strong AP strategy protects cash reserves while keeping vendors satisfied. A fractional CFO can help determine the right timing for payments and build a cash flow plan that supports stability and growth.

4. Leverage Technology for Efficiency

Although some companies still pay by check, most now use ACH payments or third party bill payment platforms such as Bill.com or Melio. These systems allow you to upload bill documents for secure record keeping, reduce the time and cost of mailing checks, and provide controlled approval workflows that help prevent fraud. Automation also reduces manual work and lowers the risk of human error.

5. Build Strong Vendor Relationships

Consistent communication and timely payments strengthen your relationships with suppliers. Strong vendor relationships can lead to better payment terms, occasional discounts, and more flexibility when your business needs support during busy or tight periods.

6. Monitor and Analyze Trends

Your AP data can highlight patterns worth addressing. Recurring invoice errors, vendors that bill late, or approval bottlenecks may indicate areas for improvement. Regular analysis helps you negotiate stronger terms, streamline processes, and make better financial decisions.

7. Maintain Compliance and Documentation

Accurate documentation is essential. Proper record keeping ensures compliance with tax and audit requirements, protects against fraud, and provides transparency for internal reviews. Good documentation also supports more accurate financial reporting and planning.

Conclusion

Effective accounts payable management is more than simply paying bills on time. It is about creating a system that supports cash flow, protects the business, and enables growth. Sentinel Finance Group can help your company manage AP by regulating payment timing, reviewing and strengthening internal processes, implementing bill pay technology, and reducing fraud risk through strong financial controls. Our financial reporting packages include both “days in AP” and “days in AR,” and we review these metrics with you regularly to ensure your cash flow stays healthy and your vendor relationships remain strong.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides CFO services and controller services to local businesses.