Growth is exciting, but expanding at the wrong time, or in the wrong way, can destroy profitability and cash flow. As a fractional CFO, I often see companies that can grow, but aren’t yet positioned to grow safely.

This guide breaks down when expansion makes sense, how to evaluate readiness, and how to expand without putting the business at risk.

Part 1: When Is the Right Time to Expand?

Expansion should be a byproduct of financial strength, not a reaction to optimism or pressure.

Here are the key indicators that suggest your business may be ready.

1. Your Core Offering Is Proven

Before expanding, your existing products or services should be:

-

- Consistently profitable

-

- Operationally repeatable

-

- Supported by stable demand

A proven core offering is essential because scaling amplifies what already works. Without a solid, validated foundation, growth can magnify inefficiencies, strain resources, and put unnecessary risk on the business.

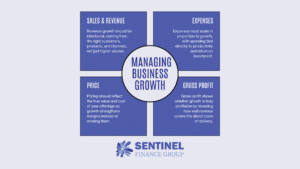

2. Gross Profit Is Strong and Predictable

Revenue growth alone is not enough. Expansion requires fuel, and that fuel is gross profit.

You should understand:

-

- Gross margin by product or service

-

- Labor efficiency trends

-

- How margins behave as volume increases

If revenue is growing but margins are shrinking, expansion will magnify the problems, not fix them.

3. Cash Flow Is Stable

Expansion almost always requires upfront cash (new hires, marketing, inventory, or systems) before returns show up.

Signs of readiness include:

-

- Predictable monthly cash inflows

-

- Adequate cash reserves

-

- Clear visibility into short-term cash needs

If the business is already struggling with managing receivables or payables, it’s not ready to scale.

4. Operations and Financial Systems Can Handle More Volume

Operational readiness isn’t just about people and processes, it’s also about financial discipline.

Before expanding, your business should already have repeatable, easy-to-manage financial systems in place, including:

-

- A rigorous annual budget tied to strategic goals

-

- Rolling forecasts that are updated regularly

-

- Consistent monthly reporting with clear KPIs

-

- A reliable monthly close process

These systems should function smoothly before expansion begins. If financial reporting is reactive, inconsistent, or overly complex today, expansion will only magnify those issues.

Ask yourself:

-

- Are financial processes documented or dependent on a few people?

-

- Do systems scale, or do they break under pressure?

-

- Can leadership quickly understand performance without digging?

Operational and financial fragility are two of the most expensive hidden risks in expansion.

Part 2: Common Expansion Mistakes

Many expansion failures are due to unrealistic expectations. Here are some common mistakes to look out for:

Expanding Revenue Before Profitability

Growing an unprofitable or low-margin offering simply increases losses faster.

Profitability should lead growth, not trail it.

Hiring Too Early

Adding headcount before workloads locks in fixed costs that reduce flexibility.

A better approach:

-

- Stress-test current capacity

-

- Use contractors or temporary support first

-

- Hire only when demand is proven and sustained

Expecting Immediate ROI

Expansion rarely produces quick wins.

The inefficiencies, learning curve, and upfront costs of expansion often outweigh any economies of scale in the short term. New locations or offerings may operate at a loss for months, or even years, before reaching profitability.

Your core business must be financially strong enough to support this ramp-up period without compromising stability. Expansion is a long-term investment, and its payoff should be evaluated over years, not quarters.

Assuming Growth Will “Fix” Cash Flow

Growth often worsens cash flow in the short term.

More customers usually means:

-

- More receivables

-

- Higher payroll

-

- Larger operating expenses

Without planning, growth can create a cash crisis, even in profitable companies.

Part 3: How to Expand the Right Way

Once the business is financially and operationally ready, expansion should be intentional and measured.

Step 1: Define the Expansion Goal

Expansion should solve a specific problem or unlock a clear opportunity.

Examples:

-

- Increasing capacity to meet existing demand

-

- Entering a new market with proven demand signals

-

- Improving margins through pricing or mix changes

Avoid expanding simply because competitors are growing or revenue has increased.

Step 2: Model the Financial Impact

Before committing, you should understand:

-

- Expected return on investment

-

- Impact on cash flow over time

-

- Break-even point for the expansion

It’s also critical to account for startup and one-time costs, which may include:

-

- Securing or building out a new location

-

- Hiring and training new staff

-

- Capital expenditures such as equipment, machinery, or vehicles

These assumptions should be built into a financial model that clearly shows:

-

- How much cash is required upfront

-

- How much additional cash may be needed each month during ramp-up

-

- When the expansion is expected to reach profitability

This doesn’t require an overly complex model, but it does require realistic assumptions and clear visibility into downside risk.

Step 3: Expand in Phases

Rather than making one large bet:

-

- Test on a smaller scale

-

- Measure performance against expectations

-

- Adjust before fully committing

Phased expansion preserves optionality and limits downside risk.

Step 4: Align Expansion With Cash Strategy

Growth should be paired with:

-

- Strong accounts receivable processes

-

- Thoughtful timing of expenses

-

- Adequate working capital

Expansion without cash discipline is one of the fastest ways to stall a growing business.

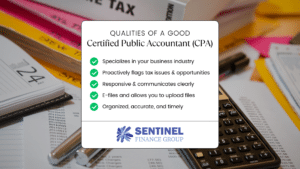

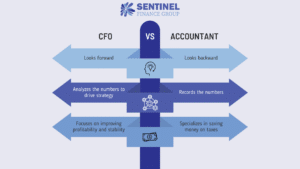

Part 4: The Role of a Fractional CFO in Expansion

A fractional CFO helps owners move from reactive growth to intentional, well-capitalized expansion.

At Sentinel Finance Group, we help businesses build the financial structure that serves as a blueprint for expansion, including:

-

- Designing budgeting, forecasting, and reporting systems that scale

-

- Preparing professional financial reporting to support lender and investor conversations

-

- Planning and modeling expansion scenarios to understand risk, cash needs, and timing

-

- Integrating new locations or offerings into existing reporting so performance is visible from day one

The right financial foundation doesn’t slow expansion; it ensures profitability is reached as efficiently as possible without putting the core business at risk.

Sentinel Finance Group brings decades of experience providing fractional CFO and controller services to small and mid-sized businesses and has extensive expertise in real estate, construction, and logistics.