Growth is the goal for most business owners, but growth alone doesn’t guarantee success. In fact, unmanaged growth is one of the fastest ways a profitable business sees margins shrink and profits decline.

At its core, properly managing a company’s growth means ensuring that increased activity translates into increased profitability. It should not simply result in more revenue, more employees, and more complexity.

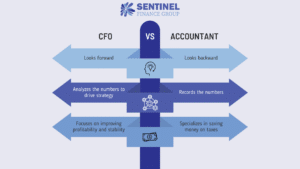

From a CFO perspective, sustainable growth comes down to managing four interconnected areas:

- Sales and revenue

- Expenses

- Pricing

- Gross profit

When these four levers are aligned, growth becomes a driver of long-term value rather than a hidden risk.

1. Sales and Revenue: Growth With Intent

Revenue growth is often treated as the primary indicator of success. While sales growth is important, it is only valuable when it is intentional and supported by the rest of the business.

Key questions to ask:

-

- Is revenue growth coming from higher volume, higher prices, or new offerings?

-

- Are certain customers, products, or channels significantly more profitable than others?

-

- Can operations, staffing, and cash flow support the current pace of growth?

Without this clarity, companies often chase revenue at any cost. This can mean discounting heavily, onboarding low-margin customers, or scaling faster than their infrastructure allows. The result is often increasing revenue but declining profit margins. A CFO helps ensure revenue growth is strategic, measurable, and sustainable.

2. Expenses: Scaling Without Losing Control

As revenue grows, expenses naturally increase. However, not all expenses should grow at the same rate. One of the biggest profitability killers during growth phases is expense creep.

Common challenges include:

-

- Hiring ahead of need without productivity benchmarks

-

- Rising overhead that does not directly support revenue

-

- Lack of visibility into fixed versus variable costs

Strong financial leadership brings discipline to expense management by:

-

- Establishing budgets tied to growth goals

-

- Monitoring expense ratios, not just dollar amounts

-

- Ensuring new spending has a clear return on investment

The goal is not to cut costs. The goal is to scale expenses intentionally and proportionally.

3. Pricing: The Most Underutilized Growth Lever

Pricing is one of the most powerful, and most overlooked, drivers of profitability. Many growing businesses underprice their offerings out of fear of losing customers or slowing growth.

Even small pricing adjustments can have an outsized impact on the bottom line.

A CFO-driven pricing strategy considers:

-

- The true cost to deliver each product or service

-

- Customer willingness to pay

-

- Competitive positioning

-

- The impact of discounts and custom pricing

Growth without regular pricing review often leads to higher workloads, tighter margins, and frustrated teams. Strategic pricing ensures that growth improves profitability instead of diluting it.

4. Gross Profit: The Foundation of Sustainable Growth

Gross profit represents the revenue generated by a product or service minus the direct costs required to deliver it. It is one of the most important measures of a company’s financial health and one of the hardest areas for growing businesses to manage well.

As companies scale, gross profit becomes harder to track accurately because it requires costs to be allocated to the correct revenue lines in the correct months. When labor, materials, or delivery costs are lumped into broad expense categories, it becomes difficult to see what is truly driving or eroding profitability.

Managing gross profit effectively means:

-

- Understanding margins by product, service, and customer

-

- Properly assigning costs to the specific revenue they support

-

- Monitoring how labor, materials, and delivery costs change as volume increases

-

- Identifying products or services where costs are growing faster than revenue

When costs are accurately matched to revenue, leaders can quickly spot low-margin work, pricing issues, or operational inefficiencies before they spiral out of control. When gross profit is healthy and consistent, the business has room to invest in people, systems, and future growth. When it is ignored, growth amplifies inefficiencies instead of returns.

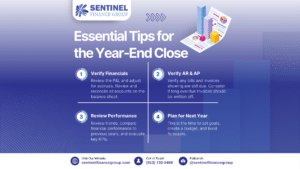

Bringing It All Together

Many companies grow quickly but fail to see a corresponding increase in profits. As businesses scale, inefficiencies naturally emerge. More people, more systems, and more complexity often erode margins unless growth is actively managed.

That is why it is critical to forecast expected revenue and profit increases when hiring additional employees or investing in new areas of the business. These expectations should then be tracked against actual results. When performance falls short, leaders need to analyze the variances and understand what changed. Was it pricing, productivity, costs, or a mix?

The earlier a company builds this discipline, the easier growth becomes to manage. Over time, complexity increases and problems become harder and more expensive to untangle. When the right financial structures, forecasts, and review processes are in place from the beginning, maintaining and growing profitability becomes far more achievable.

At Sentinel Finance Group, we help clients grow intentionally by consistently reviewing the four key areas of growth management: sales and revenue, expenses, pricing, and gross profit. Through monthly financial reviews, we analyze KPIs, ratios, and expense trends to provide clear, actionable insight into what is truly driving performance. This structured approach ensures growth is planned, measured, and adjusted–not accidental. If your business is scaling and you want confidence that profitability is scaling with it, this level of financial discipline is essential.

Sentinel Finance Group brings decades of experience providing fractional CFO and controller services to small and mid-sized businesses and has extensive expertise in real estate, construction, and logistics.