One tax form that often causes confusion is the 1099-NEC, used to report payments to non-employees like independent contractors. As a fractional CFO, I often see companies make simple mistakes on this form, which can lead to penalties or delayed filings. Here’s what business owners need to know to stay compliant.

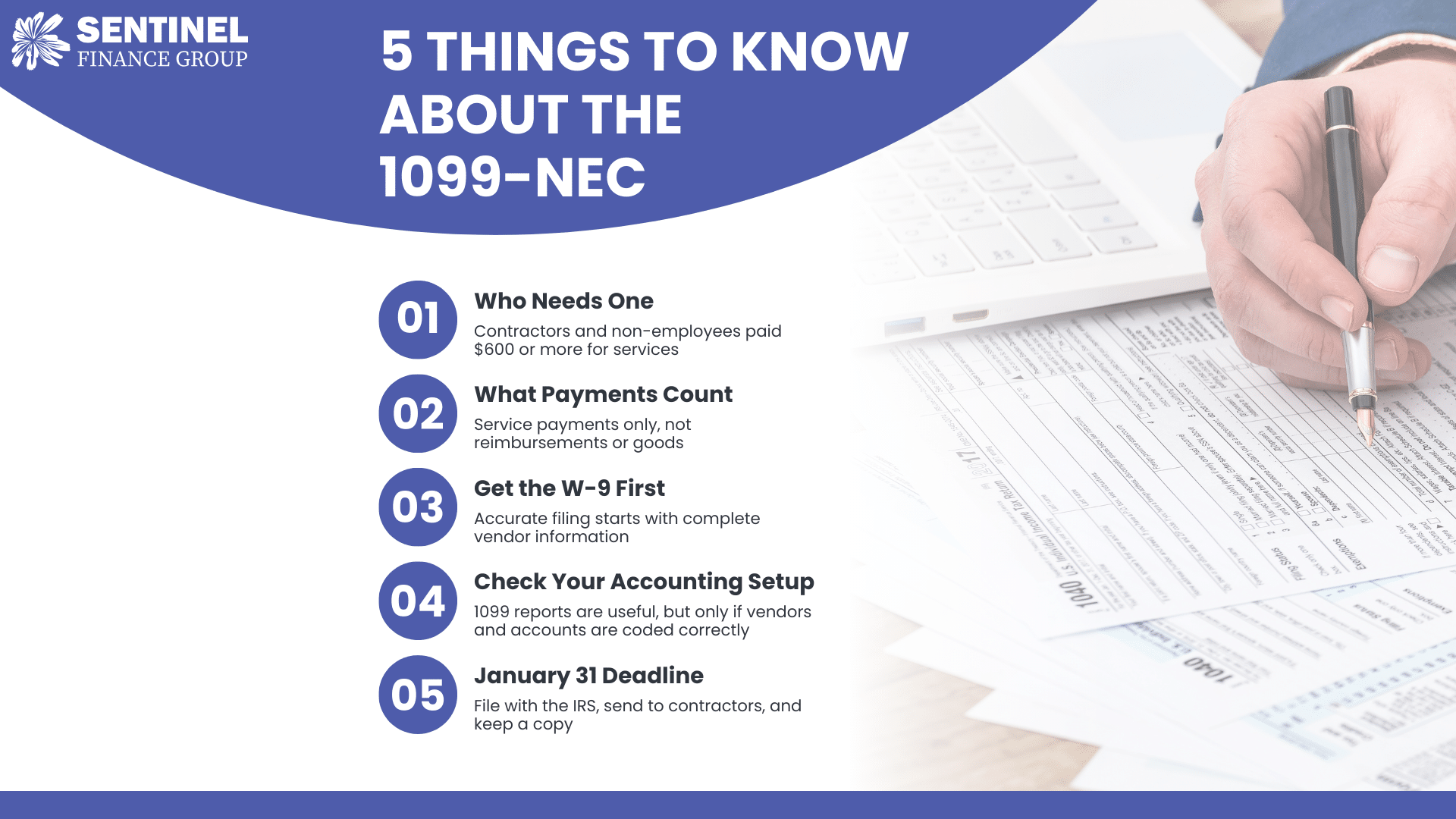

Understand the purpose of the 1099-NEC

The 1099-NEC was reintroduced in 2020 to report payments of $600 or more to non-employees. Its purpose is to notify the IRS of non-employee compensation and provide contractors the information they need to file their taxes.

Know who should receive it

The form is for individuals or entities you’ve paid for services who are not your employees. This includes freelancers, consultants, and independent contractors. Payments to corporations usually do not require a 1099-NEC, though there are exceptions, such as attorney fees.

Collect W-9 forms early

Accuracy starts with proper documentation. Before making payments, obtain a completed Form W-9 from each contractor. This form provides the legal name, business name if applicable, address, and Taxpayer Identification Number needed to file correctly.

Track payments carefully

Only payments for services are reportable. This includes cash, checks, and electronic payments like PayPal or Venmo when not for personal transactions. Payments for goods or reimbursements generally do not count, but mixing these with service payments can create confusion if records are unclear.

Use your accounting system wisely

Most accounting systems can generate 1099 reports, which are helpful if contractors are correctly marked and all payments to them are recorded in the right expense categories. Check your setup carefully to make sure nothing is missed or reported incorrectly.

Meet the deadlines

1099-NECs must be filed with the IRS and provided to recipients by January 31 for the previous year’s payments. If this date falls on a weekend, the deadline moves to the next business day. Filing late can trigger penalties, so mark your calendar early.

Consider e-filing

Businesses filing 10 or more information returns are required to e-file, but it can save time and reduce errors even for smaller companies. E-filing ensures the IRS receives your forms on time.

Be aware of penalties

Filing incorrect or late 1099-NECs can result in penalties ranging from $60 to $340 per form, depending on how late corrections are made. Repeated late or missing filings may also trigger audits.

Plan ahead for next year

Simplify 1099-NEC season by keeping clear records, collecting W-9s, and considering accounting software or guidance to ensure compliance.

Filing the 1099-NEC does not have to be stressful. Knowing who qualifies, keeping accurate records, and meeting deadlines will help your business avoid penalties and maintain good relationships with contractors.

At Sentinel Finance Group, we guide clients through the entire 1099-NEC process. We help identify which contractors need a 1099, make sure all payments are recorded correctly, and file accurate forms with the IRS and recipients. With the right preparation, the process is simple, so business owners can focus on growing their company.

Sentinel Finance Group brings decades of experience providing fractional CFO and controller services to small and mid-sized businesses and has extensive expertise in real estate, construction, and logistics.