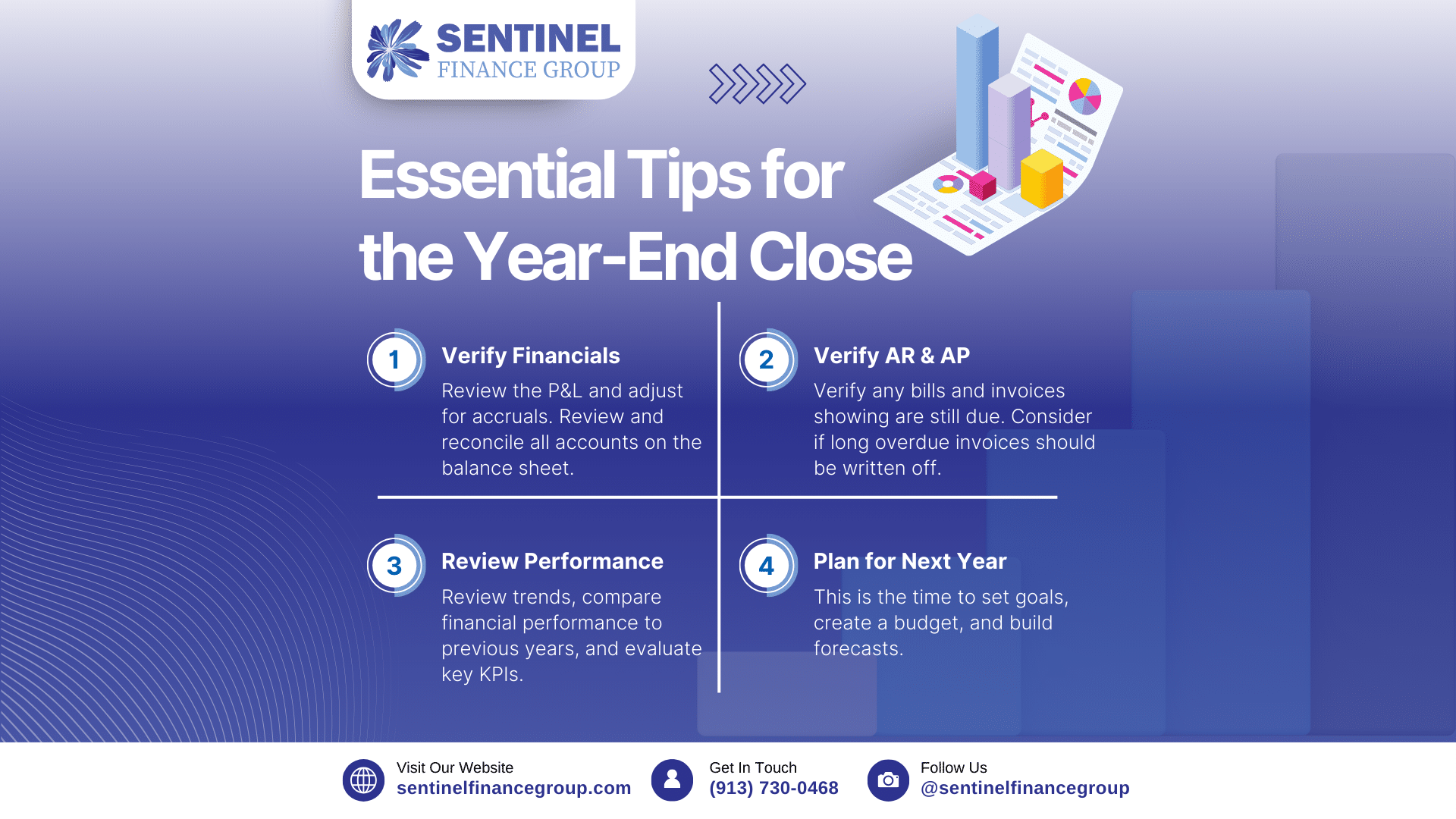

December is here, and for business owners, that means it’s time to wrap up your financial year with accuracy and intention. A thorough year-end close not only ensures compliance and clean financial statements, it also gives you the clarity you need to make stronger, more strategic decisions in 2026. Here are the essential steps to help you complete your year-end close effectively and avoid costly issues down the road.

- Map Out Your Remaining Year-End Tasks

Even in mid-December, creating a clear checklist is one of the most important things you can do. Identify what must be completed before December 31 and what can be finalized shortly after. A simple plan keeps the process organized and reduces the risk of missing critical steps.

- Reconcile Every Balance Sheet Account

A proper year-end close requires that all balance sheet accounts are reconciled, not just bank accounts. Your ending balances should match third-party statements such as bank statements, credit cards, loans, payroll reports, merchant processors, and any other external source. This is especially important because the balance sheet carries forward into the next year, making errors more complicated to fix the longer they sit.

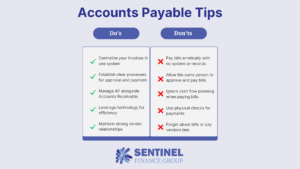

- Verify Accounts Receivable and Payable

Review your A/R and A/P aging reports to make sure the invoices and bills showing are still valid and due. Follow up on any overdue customer invoices and decide whether any old balances should be written off. Cleaning these up ensures your financials reflect reality and prevents inflated revenue or liabilities from carrying into the new year.

- Adjust Your Profit and Loss for Accruals

For accurate reporting, review your P&L and make sure everything is recorded in the proper period. Add any necessary accruals or adjustments, check for missing expenses, and ensure revenue is recognized in the correct month. These steps are essential for both tax accuracy and performance evaluation.

- Complete Your Year-End Inventory Count

If your business carries inventory, now is the time for a physical count. Update your records to reflect what’s actually on hand, and identify any obsolete or slow-moving items. Inventory errors directly impact the cost of goods sold and the accuracy of your balance sheet.

- Review Fixed Assets and Depreciation

Confirm that your fixed assets are accurately recorded and that depreciation entries are complete. This keeps your books current and ensures you are reporting the true value of your long-term investments.

- Analyze Your Year in Review

The end of the year is also your best opportunity to look back and understand how your business performed. Review trends, compare financials to prior years, identify strengths and weaknesses, and evaluate key metrics such as gross profit, gross margin, net income, and cash flow. This analysis provides the insight you need to make informed decisions in the year ahead.

- Look Ahead to 2026

Once your financials are cleaned up and reviewed, translate that information into a plan for next year. Use this time to set goals, create a budget, and build forecasts for revenue, expenses, and cash flow. Clear planning helps align your team and prepare your business for growth.

The Risks of Skipping or Rushing the Close

Skipping or rushing your year-end close can lead to serious problems. It can cause incorrect tax filings, misrepresentation of financial results, messy balance sheets that become harder to fix with time, and even opportunities for fraud to hide in unclear accounts. Inaccurate financials can also lead to poor decision-making and inaccurate business valuations. A complete and accurate close protects your business from these outcomes and gives you the financial clarity you need to move forward confidently.

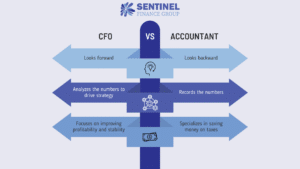

How Sentinel Finance Group Supports a Successful Close

At Sentinel Finance Group, we lead the year-end close process for our clients from start to finish. We ensure the financials are accurate, reconciled, and compliant, and we provide expert guidance on decisions such as when to book revenue or expenses and when to write off balances. We also prepare year-end reporting and walk leadership teams through key metrics, KPIs, and trends. Finally, we lead the planning, budgeting, and forecasting process to help each business enter the new year confident and prepared.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides CFO services and controller services to local businesses.