For many business owners, the finance department is a bit of a black box. You know the team handles payroll, bills, and taxes—but beyond that, it can be difficult to gauge how well the department is actually performing. An effective finance function does far more than “keep the books.” It drives clarity, efficiency, and strategy across the business.

As a business owner, your job doesn’t stop at hiring the team. It’s your responsibility to make sure the department is performing effectively and efficiently. So how do you know if your financial department is truly effective?

What an Effective Finance Department Looks Like

So what does “effective” actually mean? A strong finance department demonstrates these qualities:

1. Accuracy and Consistency

Your financials are delivered on time, free of errors, and reconciled properly. Reports are reliable, not a source of confusion or rework. Timely and accurate reporting gives leadership the visibility they need to make informed decisions.

2. Cash Flow Visibility and Forecasting

An effective department doesn’t just tell you your current bank balance—it helps you anticipate your cash position 30, 60, or 90 days out so you’re never caught off guard.

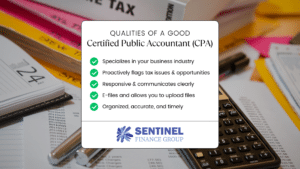

3. Expertise and Compliance

Your finance team understands the regulations that apply to your industry and location. They have the training and qualifications to keep you compliant and avoid costly mistakes.

4. Flexibility and Adaptability

Finance today is fast-moving. Your team should be comfortable with financial software, able to adjust to changing rules, and willing to find efficient solutions instead of overly complex, time-intensive ones.

5. Decision-Ready Insights

Numbers by themselves don’t drive growth—insights do. A strong department translates data into KPIs, trends, and recommendations that help leadership make better decisions.

6. Streamlined, Efficient Processes

Manual spreadsheets and workarounds create errors and waste time. An effective department has systems and controls that improve efficiency and accuracy.

7. A Strategic Seat at the Table

Finally, the best finance departments don’t operate as a back-office function. They participate in budgeting, growth modeling, investment evaluation, and risk assessment—helping shape the future of the business.

Red Flags That Your Department May Be Falling Short

If you don’t have a financial background, spotting issues can feel daunting. Here are some common warning signs:

-

- Customers or vendors complain about missed or incorrect invoices

-

- Bills aren’t paid on time

-

- You’re often surprised by unexpected cash shortages or scrambling to cover expenses

-

- Financial statements contain errors or inconsistencies

-

- A bank denies a loan because your numbers don’t make sense

-

- Monthly financials and reports are late month after month

-

- You see numbers that don’t add up—and your team can’t explain why

-

- The leadership team is making decisions that aren’t informed by financial data

If you recognize any of these, it may be time to reassess how effectively your department is operating.

What To Do If You’re Unsure

An effective financial department does far more than “keep the books.” It empowers leaders with clarity, foresight, and strategy. If you’re not confident your finance team is providing that level of value, you don’t have to navigate the uncertainty alone.

At Sentinel Finance Group, we help business owners audit their financial departments, identify gaps, and strengthen processes. Whether you need better systems, additional training, or a fractional CFO to provide executive-level expertise, we ensure your financial department becomes a true driver of business success.

Contact us today to schedule a consultation and evaluate the effectiveness of your financial department.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides CFO services and controller services to local businesses.