Most companies understand the value of budgeting. It’s a fundamental part of financial planning, offering a structured, annual roadmap for managing revenue and expenses. However, many businesses stop there—overlooking a critical companion to budgeting: forecasting.

While budgeting lays the groundwork, forecasting is the ongoing process that keeps a company financially agile and strategically informed. Together, they form a more complete picture of a company’s financial health and future.

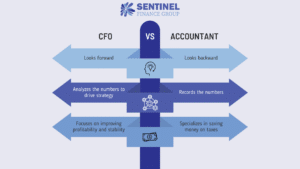

Budgeting vs. Forecasting: Key Differences

A budget is typically developed before the start of a fiscal year. It outlines expected revenue, sets spending limits, and defines financial goals based on assumptions made at a single point in time. Budgets are static and serve as a benchmark to measure performance throughout the year.

A forecast, by contrast, is dynamic. It is continually updated—monthly, weekly, or even daily—based on current trends and actual business performance. Forecasting allows companies to adjust expectations and resources in real time, rather than relying solely on projections made months earlier.

Why Forecasting Matters

Many companies are unaware of the need to forecast in addition to budgeting, but the benefits are clear:

-

- Budgets become less reliable as real-world conditions shift.

-

- Forecasting delivers a more accurate, real-time picture of expected outcomes.

-

- It enables faster, data-driven decision-making, such as whether to hire, launch new revenue streams, or cut back on underperforming initiatives.

-

- It supports scenario planning, allowing leadership to model and prepare for different financial outcomes before they occur.

By layering forecasting on top of budgeting, companies are better equipped to respond to changing market conditions, evolving customer demands, or internal operational shifts.

Forecasting During Economic Downturns

Forecasting becomes even more critical during periods of economic uncertainty or downturn. When consumer behavior, supply chains, or capital availability shift rapidly, companies need timely insights to stay steady.

In challenging times, forecasting provides:

-

- Clarity amid volatility, helping leaders identify risks early and respond proactively

-

- A tool for financial discipline, guiding companies to adjust spending, protect margins, and preserve cash

-

- Confidence in decision-making, offering a flexible framework to reallocate resources or restructure priorities

-

- A sense of stability, even when external conditions are changing

Companies that forecast regularly are more adaptable and better able to navigate change without panic. Instead of making reactive cuts or decisions in the dark, they can move forward strategically—with a plan grounded in current data.

With the right financial systems in place, downturns can become opportunities to strengthen operations, improve efficiency, and emerge even more resilient.

A Collaborative Process

Effective forecasting is a cross-functional effort. Involving all departments helps ensure that forecasts reflect the full scope of the business. For example:

-

- The sales team should provide input on projected revenue based on pipeline data.

-

- The operations team can offer insight into production timelines and associated costs.

-

- The HR department can share updates on hiring plans and personnel costs.

When each department is involved, the numbers become more accurate—and each team becomes more accountable for delivering on their part of the plan.

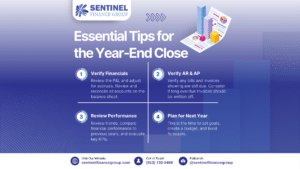

How Sentinel Finance Group Supports Forecasting

Sentinel Finance Group works with businesses to create both reliable budgets and forward-looking forecasts. We help clients:

-

- Develop comprehensive budgets aligned with business goals

-

- Build and update rolling forecasts based on real-time data

-

- Compare forecasts to budgets and analyze variances

-

- Use financial insights to inform strategic decisions

By offering a proactive approach to financial planning, Sentinel Finance Group helps companies stay on track, identify potential issues early, and adjust course as needed.

The Bottom Line

Relying solely on a budget is like navigating with last year’s map. Forecasting adds the GPS—offering live updates and a clear view of what’s ahead. Together, budgeting and forecasting empower businesses to make smarter decisions, manage risk, and seize opportunities.

Especially during uncertain economic times, forecasting brings stability, adaptability, and financial discipline—three qualities that separate businesses that survive from those that thrive.

To learn more about how Sentinel Finance Group can help with budgeting, forecasting, and strategic financial planning, contact us today.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides CFO services and controller services to local businesses.