A company’s accounts receivable (AR) balance consists of invoices that have not yet been paid. It is money that has been earned but not yet collected (usually it is collected within the next 30-90 days).

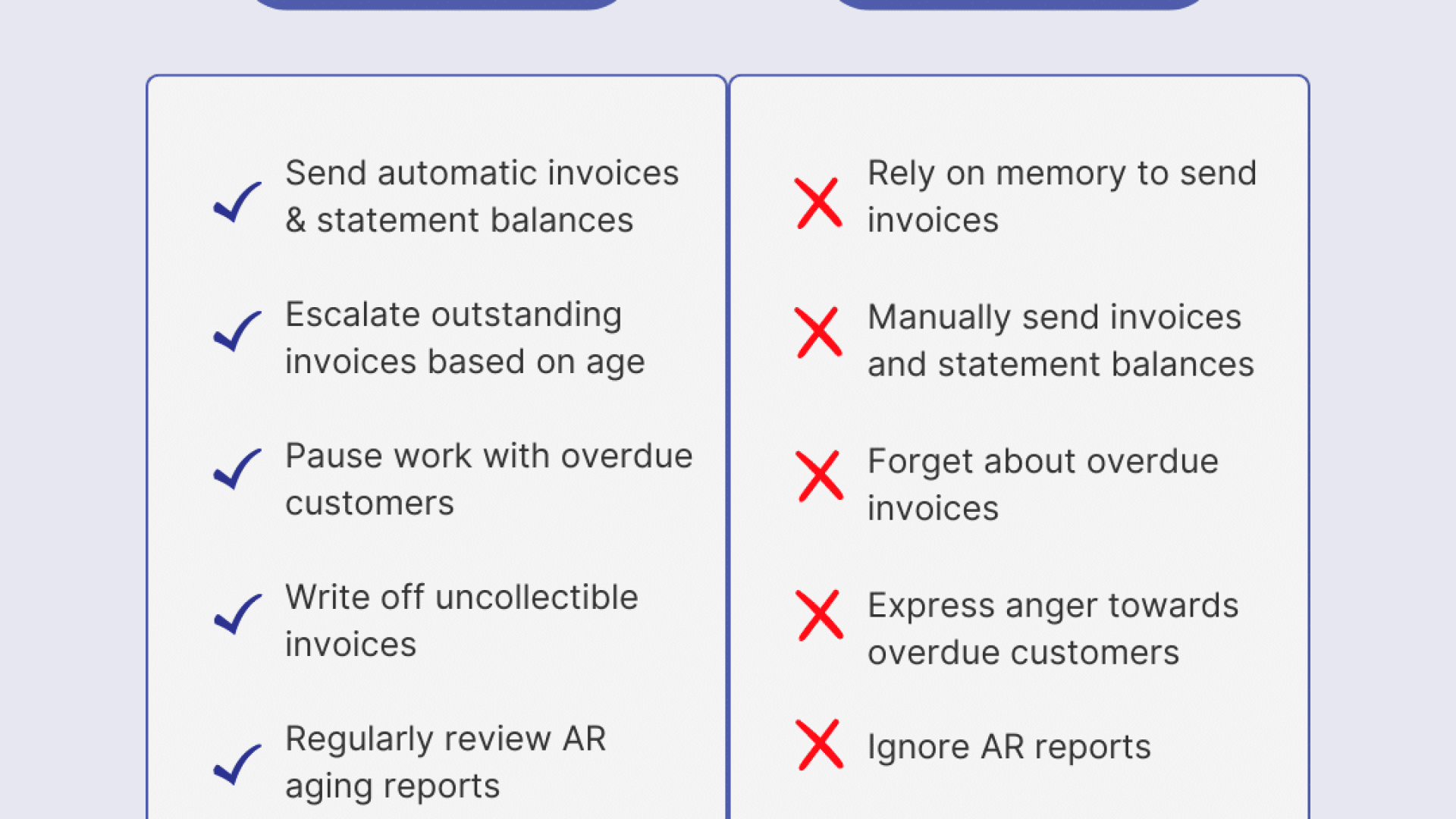

A business should have a system for managing AR. At minimum, a bookkeeper should take notes regarding communications and reminders for overdue invoices. Ideally, your accounting system automatically sends out invoices and regularly sends out statements showing outstanding balances to your customers. There should also be an escalation system in which outstanding invoices are escalated within the business based on age. It may be sufficient to send emails or statement reminders for invoices that are less than 30 days. When an invoice is between 30-60 days old, it may need to escalate to management, and invoices older than 90 days old may need to escalate up to the business owner. In any case, it’s important to remember that attempts to collect on invoices should always remain professional and organized in order to preserve customer relations and your business reputation.

What do you do when customers don’t pay? Beyond escalation and reminders, one of the only other options is small claims court (unless it’s a very large amount due). The best course of action is to stop work with any customers who are very overdue. Invoices that a business owner deems as not collectible (usually older than 90 days), can be written off as bad debt.

It’s also important to regularly review your AR. Your financial department should pull AR aging reports with outstanding invoices. “Days in AR” is an important metric to track. This is the average number of days your invoices sit in AR before being paid (the lower this number is, the faster you are getting paid). If your invoices are due in 30 days, you want this metric to be as close to 30 days as possible. If this metric is higher than you want it to be, you should make improvements to your process for managing AR.

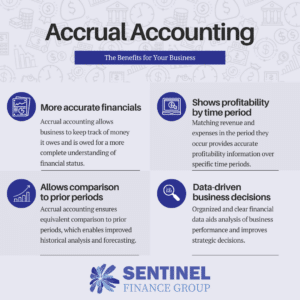

Sentinel Finance Group can help you create a system for managing and automating your Accounts Receivable processes. We can help you write off bad debts, run AR aging reports, & review them in regular financial reviews.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.