Many small business owners hire a bookkeeper and assume this is all their business needs in terms of a financial department. After all, many business owners function for years with this strategy. And yes, your business can probably survive with only a bookkeeper. But I want to bring attention to a few reasons you may be leaving money and growth on the table with this strategy.

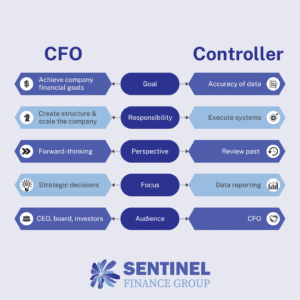

First, a bookkeeper focuses solely on entering and categorizing financial data. You also need someone on your team who is analyzing that data and making sense of the overall picture. A CFO uses the information to look forward and help you make informed decisions about your company. For example, a CFO will tell you how to use resources more effectively, which lines of revenue to focus on, if your COGS or inventory is too high, how you compare to competitors, and if your employees are effective. A bookkeeper does not typically have training or expertise in these areas.

Second, relying only on a bookkeeper without oversight from an expert could result in costly errors. A CFO provides guidance and direction to ensure that the structure and system a bookkeeper uses is correct. For example, a bookkeeper often does not have clear and consistent rules for categorizing financial data. The financials become excessively complex which makes it impossible to clearly and professionally present the data for financial statements. This issue compounds if you keep replacing your bookkeeper, because without procedures and direction, each new bookkeeper will use a new system of categorization. It becomes very difficult and expensive to disentangle later.

Lastly, a bookkeeper does not have the training and expertise necessary to provide the financial leadership for your company. You will need someone in your company who can clearly communicate and present the financial analysis in a professional manner. A CFO has the training and experience necessary to understand and interpret financial data, and to make actionable recommendations based on it. He or she knows how to effectively and professionally communicate this information to investors and boards, which gives stakeholders confidence in your company’s capability.

Business owners are often worried about the cost of hiring CFO services, but the truth is, it’s more costly in the long run to sacrifice growth. It’s risky to make financial decisions without relying on a trained professional. CFO services are important no matter what stage your business is at, and we tailor our services based on your unique business situation.

Do you want to know if your business could benefit from CFO services? I’m happy to review your unique business situation and provide some recommendations free-of-charge. Book a call with me here.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.